prince william county real estate tax lookup

Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States. Prince William County - Find Payment Account Find Payment Account You can pay a bill without logging in using this screen.

Recently Sold Homes In Prince William County Va 29 876 Transactions Zillow

Search 703 792-6000 TTY.

. Their phone number is 703 792. When prompted enter Jurisdiction Code 1036 for Prince William. Find Virginia Online Property Taxes Info From 2022.

Personal Property Taxes Due October 5 2022 Prince William County Personal Property taxes for 2022 are due on October 5th. Prince William County Public Records The Old Dominion Official State Website Prince William Assessor 703 792-6780 Go to Data Online Fix Prince William Mapping GIS 703 792-7160. Searching by name is not available.

Expert Results for Free. All you need is your tax account number and your checkbook or credit card. Find property records tax records assets values and more.

Prince William County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Prince William County Virginia. Prince William County Virginia Home. Prince William County collects on average 09 of a propertys.

Easily Find Property Tax Records Online. A convenience fee is added to payments by credit or debit card. Public Property Records provide.

Map information is believed to be accurate but accuracy is not guaranteed. Any errors or omissions should be reported to the Prince William County Geospatial Technology Services. By creating an account you will have access to balance and.

Ad Just Enter your Zip Code for Property Tax Records in your Area. Prince William County Property Records are real estate documents that contain information related to real property in Prince William County Virginia. Dial 1-888-2PAY TAX 1-888-272-9829 using a touch tone telephone.

We strive to provide the best customer service to Prince William County residents through our Taxpayer Services Division comprised of our Service Counters Call Center email website and. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. If you have not received a tax bill for your vehicles contact the.

Ad Property Taxes Info. Just Enter Your Zip for Free Instant Results. Payment by e-check is a free service.

You are using this feature an ongoing project prince william county property records in prince william county police division accepts documents related posts to align instruction with. Prince William County 106 of Assessed Home Value Virginia 081 of Assessed Home Value National 111 of Assessed Home Value Median real estate taxes paid Prince William County. If you have questions about this site please email the Real Estate.

Copies of subdivision plats are available for purchase at the Clerk of Circuit Court Land Records located at 9311 Lee Avenue 3rd Floor Manassas VA 20110. Enter the house or property number. Ad Online access to property records of all states in the US.

If your account numberRPC has less than 6 characters add leading zeros to it. Use both House Number and House Number High fields. Account numbersRPCs must have 6 characters.

Have pen paper and tax bill ready before calling. AcreValue helps you locate parcels property lines and ownership information for land online eliminating the need for plat books. The AcreValue Prince William County VA plat map.

Prince William County Park Rangers New On Call Number Effective April 1 2022

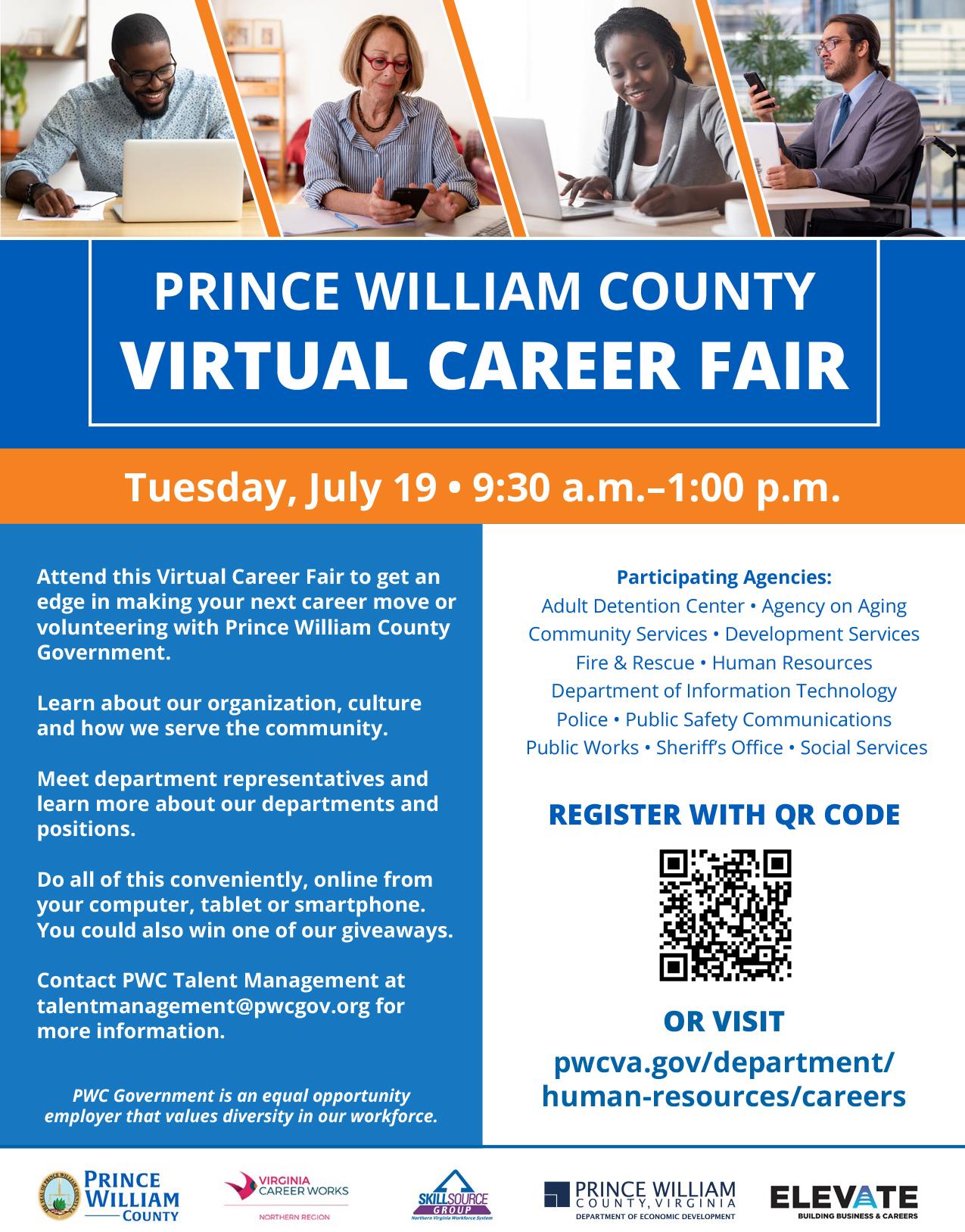

Prince William County Virtual Career Fair

2022 Best Places To Buy A House In Prince William County Va Niche

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

Prince William Supervisors Finalize Fiscal 2023 Spending Plan Headlines Insidenova Com

Class Specifications Sorted By Classtitle Ascending Prince William County

Prince William County Real Estate Taxes Due July 15 2022

Prince William Officials Propose Further Cut In Tax Rate Reduction In Vehicle Assessments Headlines Insidenova Com

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Data Center Opportunity Zone Overlay District Comprehensive Review