nanny tax calculator canada

The Nanny Tax Company has moved. This breaks down to 62 for Social Security and 145 for Medicare.

Nanny Pay Services For Households Heartpayroll

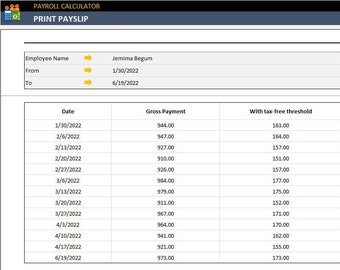

Calculation of net and gross pay taxes CPP and EI amounts.

. Find out what expenses are eligible for this deduction who can make a claim and how to calculate and claim it. Form TD1-IN Determination of Exemption of an Indians Employment Income. Our experts are available to answer your questions about paying household employees.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043That means that your net pay will be 37957 per year or 3163 per month. Our payroll services will take care of. Southern Utah Fly Fishing.

Our new address is 110R South. A household employer is responsible to remit 765 of their workers gross wages in FICA taxes. Cost Calculator for Nanny Employers.

How often is it paid. Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions. To 5 pm assign and supervise the tasks.

This is based on the 20222023 tax year using tax code 1257Lx and is relevant for the period up to and including 050722 this will be updated again. A household employer is responsible to remit 765 of their workers. Paying your nanny via direct deposit.

Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator. Nanny Tax Specialists HomePay Service Stats and Expert Support for from. Heres an example to highlight the differences between nanny take home pay employer out of pocket expense and the nannys hourly wage based on gross pay of 600week and net pay of.

You are considered to be an employer when all the following apply to you. Talk to a Specialist. Nanny Tax Calculator Canada.

This calculator will help you understand the total cost of employing a nanny and how much the nanny will take home. Calculation of net and gross pay taxes CPP and EI amounts. Canada Revenue Agency CRA registration.

Use The Nanny Tax Companys hourly nanny tax calculator to calculate nanny pay and withholding. A household employer is responsible to remit 765 of their workers gross wages in fica taxes. This calculator provides calculations based on the information you provide.

Line 21400 Child care expenses. Your average tax rate is. Creeks Rivers.

Lines 21999 and 22000 Support payments. To 5 pm assign. Employers need to withhold around 13-20 of their nannys gross wages to pay for the nanny tax.

Fill in the salary. The Nanny Tax Calculator. As for Social Security and Medicare tax payment 765 will be shouldered by.

Establish regular working hours for example 9 am. Best Fishing Near St.

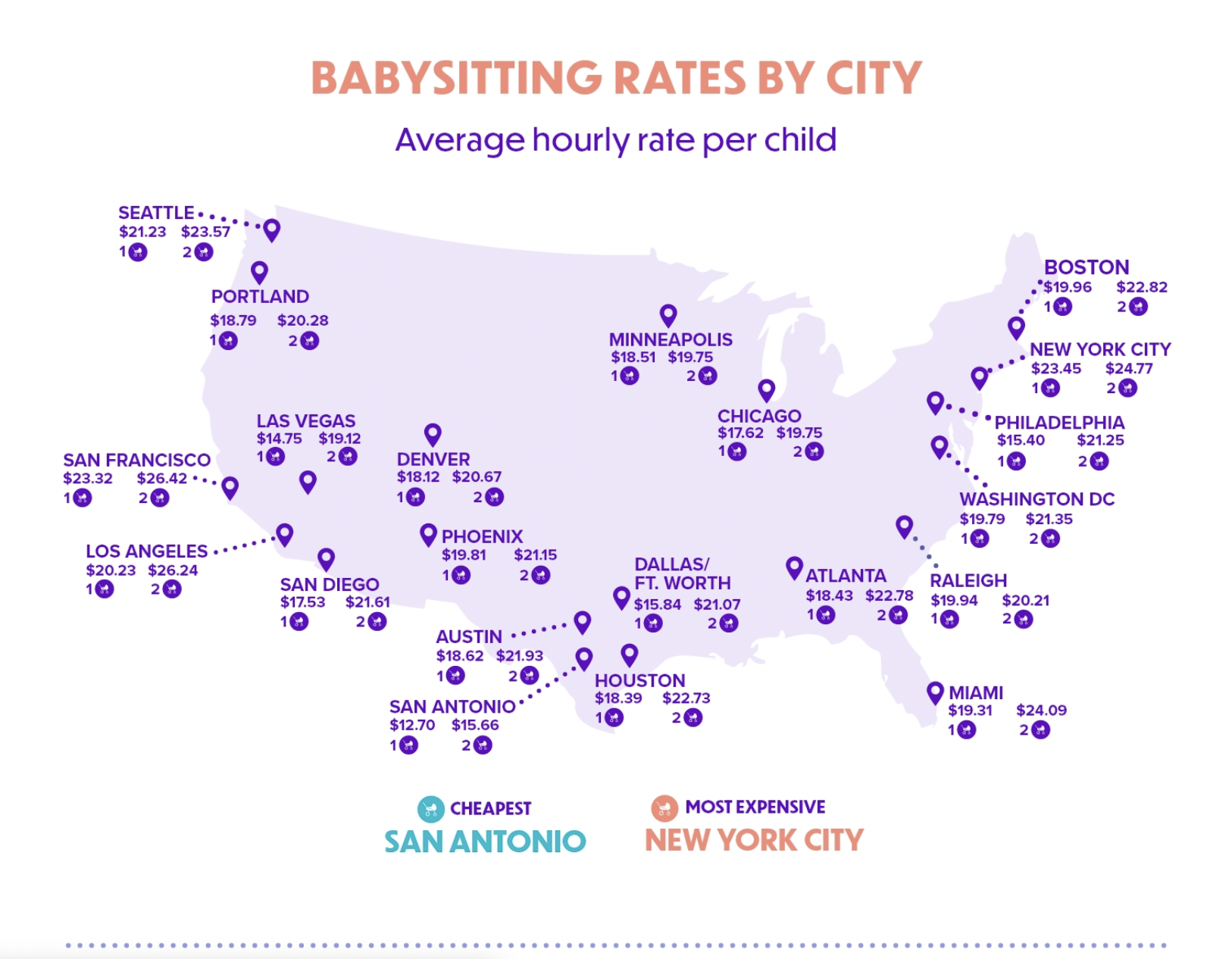

Parenting Babysitter Nanny And Infant Care Blog Nannypod

Tax Changes For 2022 Kiplinger

Sponsored Canada Nanny Jobs 2022 Canada Immigration 2022 Canadian Nanny Placement Agencies Youtube

How Much Does It Really Cost To Hire A Full Time Nanny R Nanny

Tax Definitions Tax Glossary I Tax Defense Network

Parenting Babysitter Nanny And Infant Care Blog Nannypod

Payroll Remittance And Payout Once Cpp Hits Max R Personalfinancecanada

The 10 Best Nanny Payroll Services Business Org

Tax Definitions Tax Glossary I Tax Defense Network

Salary Calculator Canada Salary After Tax

16 Real Estate Tax Deductions For 2022 2022 Checklist Hurdlr

Payroll Tax Rates 2022 Guide Forbes Advisor

Nanny Payroll Service Nannychex

Tax Deduction For Legal Fees Is Legal Fees Tax Deductible For Business

Paying A Nanny Partly On Off The Books Homework Solutions

How To Pay A Nanny Caregiver In Canada Net Vs Gross Vs Out Of Pocket Nanny Pay Services For Households Heartpayroll